At link and attached is the Legislative Policy and Research Office summary of the federal CARES Act.

Unemployment

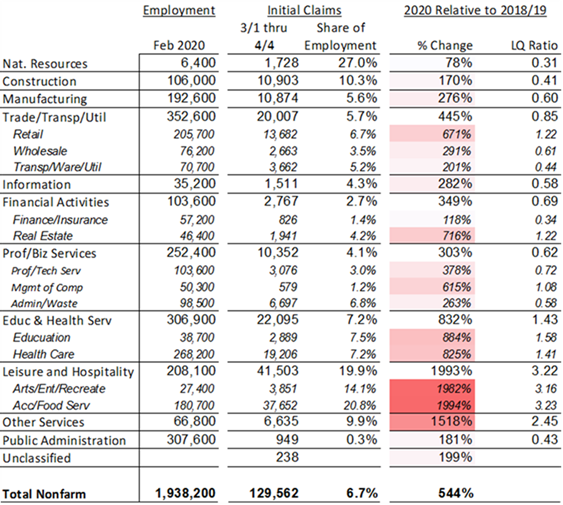

Senator Boquist sent me this unemployment by sector chart which I found interesting:

Main Street America

MSA conducted an online survey last week to assess the impact of COVID-19. More than 5,850 small businesses responded to the survey, with more than 40 percent of those operating in communities with less than 10,000 residents. Some summary findings:

- Of the nation’s approximately 30 million small businesses, nearly 7.5 million small businesses may be at risk of closing permanently over the coming five months, and 3.5 million are at risk of closure in the next two months.

- Approximately 35.7 million Americans employed by small businesses appear to be at risk of unemployment.

Is the Money Coming?

This week is the start date for the $1200 per person direct payments going out to individuals who have used direct deposit for their income tax refunds in the past. But what if you haven’t used direct deposit or if you haven’t had to file a tax return for the last couple of years? Congressman Earl Blumenauer reports that progress has been made to rectify that problem and provides good information about ways in which people in that situation can speed up their payments here: https://blumenauerforms.house.gov/news/email/show.aspx?ID=F3ND3GWVCQZFGM7WGUIKZ24HK4

Or you can just receive paper checks, which will be distributed as such:

- Taxpayers with income up to $10,000: April 24

- Taxpayers with income up to $20,000: May 1

- Taxpayers with income up to $40,000: May 15

- The rest of the checks will be issued by gradually increasing income increments each week.