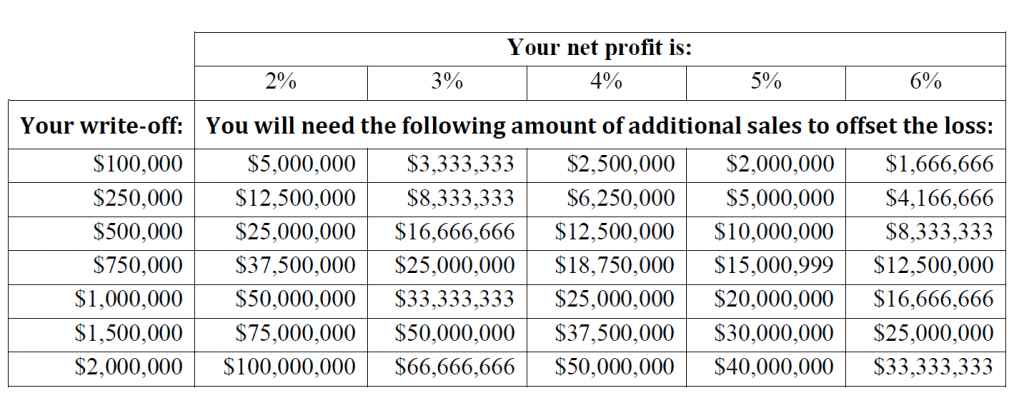

The importance of cash flow is undeniable; the write-off of bad debts affects more than your firm’s cash flow; it also impacts sales and marketing efforts. The table below shows the “multiplier” impact on sales from bad debt write-offs.

For example, you have an account that you write-off for $100,000, and that sale had a 2% profit. To compensate for the loss, you would need to produce an additional $5,000,000 in sales to offset the loss of profit on the $100,000 in write-offs.

NACM CS is certified by Commercial Collection Agencies of America and can help recover your bad debt. Our collector’s primary focus is to collect debts and knows the techniques to get you paid. Delinquent accounts not only cost you time—they also drain your company’s profits. NACM Commercial Services is here to help!

You can find more information about NACM’s Collection Services by visiting our website or contacting your Account Executive. We would be delighted to partner with you.

Customer Service: 800.622.6985